Tax brackets 2020 calculator

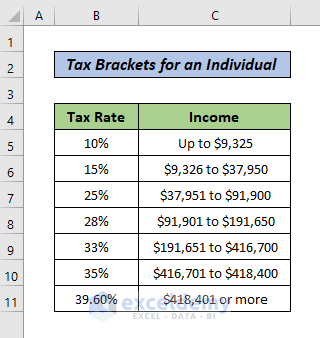

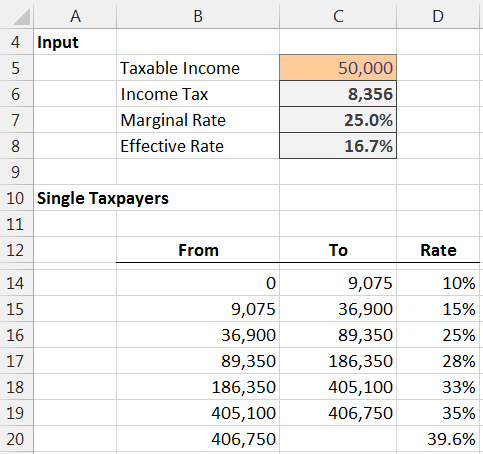

The current tax rates 2017 consist of 10 15 25 28 33 35 and 396. 2020 Simple Federal Tax Calculator Enter your filing status income deductions and credits and we will estimate your total taxes for tax year 2020.

Tax Brackets For Self Employed Individuals In 2020 Shared Economy Tax

This calculator shows marginal rates for the current year.

. How Income Taxes Are Calculated First we. 2020 Marginal Tax Rates Calculator. Based on your projected tax withholding for.

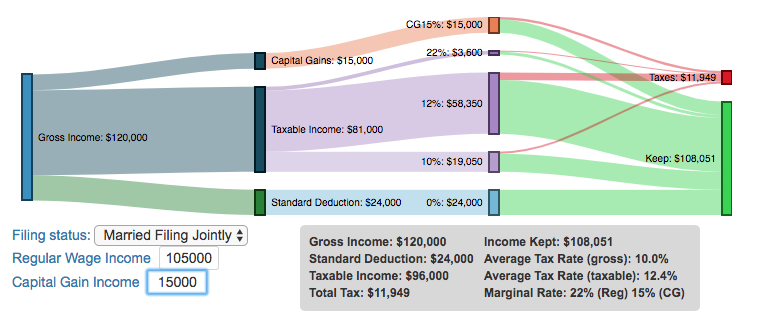

And is based on. Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP. Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan.

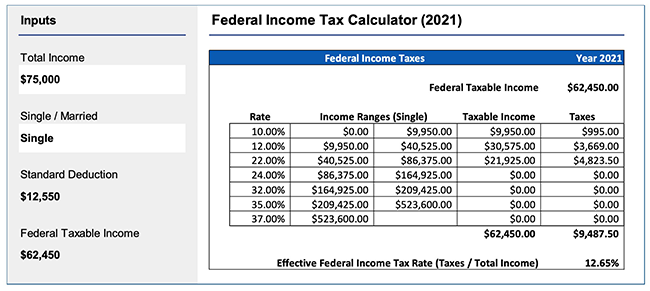

10 12 22 24 32 35 and 37. In 2020 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows Table 1. Income Tax Calculator The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return.

The lowest tax bracket or the lowest income level is 0 to 9950. Federal Income Tax Return Calculator Estimate how much youll owe in federal taxes using your income deductions and credits all in just a few steps with our tax calculator. Tax brackets tax breaks Your tax bracket is determined by your taxable income and filing status.

This calculator helps you estimate your average tax rate your tax bracket and your marginal tax rate for the current tax year. Our tax refund calculator will show you how. Income Tax Bracket Taxes Owed 10 0 - 19750 10 within Bracket 12 19751 - 80250 1975 12 within Bracket 22 80251 - 171050 9235 22 within Bracket 24.

Ad Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes. The 2020 standard deduction allows taxpayers to reduce their taxable income by 4601 for single filers 9202 for married filing jointly head of household and qualifying. A tax bracket is a category used to define your highest possible tax rate based on your filing status and taxable income.

In other words your income determines the bracket you will be. Knowing your income tax rate can help you calculate your tax liability for unexpected income retirement planning or investment income. It is mainly intended for residents of the US.

How Income Taxes Are Calculated First we. There are seven tax brackets for most ordinary income for the 2020 tax year. The next six levels are.

Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan. The top marginal income tax rate of 37 percent will hit. TurboTax Has Simple Step-By-Step Instructions To Help Along The Way.

Earned income income you receive from your job s is measured against seven tax brackets ranging from 10 to 37. This calculator helps you to calculate the tax you owe on your taxable income for the full income year. It is taxed at 10 which means the first 9950 of the money you made that year is taxed at 10.

It can be used for the 201314 to 202122 income years. 10 12 22 24 32 35 and 37. The bracket you land in depends on a variety of.

Estimate your refund with TaxCaster the free tax calculator that stays up to date on the latest tax laws. 0 Estimates change as we learn more about you Income. The new 2018 tax brackets are 10 12 22 24 32 35 and 37.

Ad Dont Put It Off Any Longer. There are seven federal tax brackets for the 2021 tax year. Ad We can help with all your IRS Tax Problems.

You Can Do It. Your tax bracket depends on your taxable income and your. Your bracket depends on your taxable income and filing status.

Get Previous Years Taxes Done Today With TurboTax.

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

How To Calculate Federal Tax Rate In Excel With Easy Steps

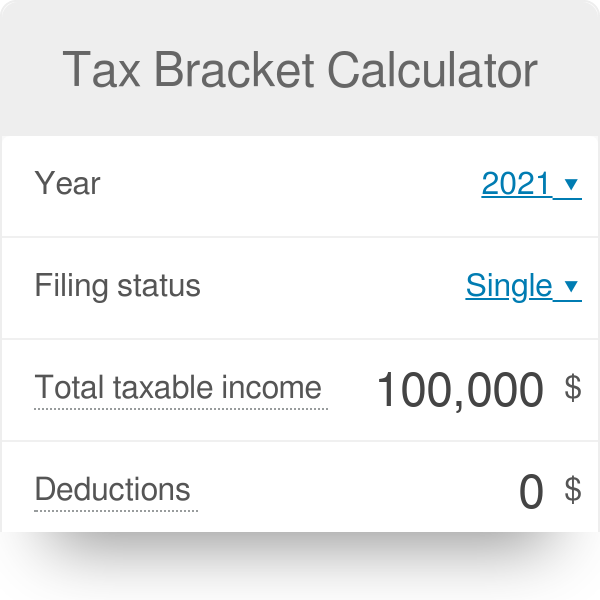

Tax Bracket Calculator

How To Calculate Federal Income Tax

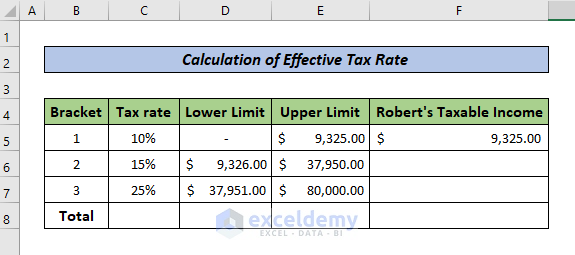

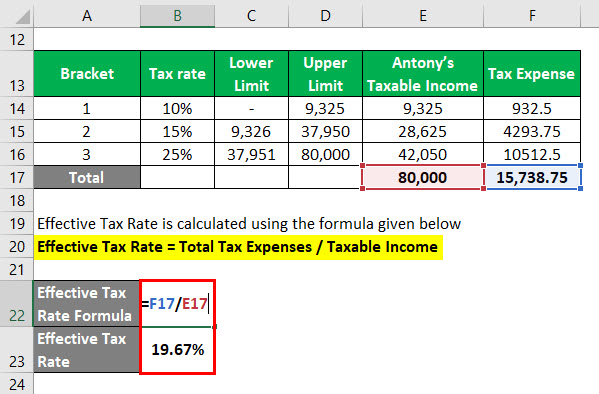

Effective Tax Rate Formula Calculator Excel Template

Effective Tax Rate Formula Calculator Excel Template

How To Calculate Federal Tax Rate In Excel With Easy Steps

Income Tax Formula Excel University

Inkwiry Federal Income Tax Brackets

Tax Calculator Estimate Your Income Tax For 2022 Free

Excel Formula Income Tax Bracket Calculation Exceljet

Paycheck Calculator Take Home Pay Calculator

Income Tax Formula Excel University

How To Create An Income Tax Calculator In Excel Youtube

How To Calculate 2020 Federal Income Withhold Manually With 2019 And Earlier W4 Form

Understanding Tax Brackets Interactive Income Tax Visualization And Calculator Engaging Data

How To Calculate Income Tax In Excel